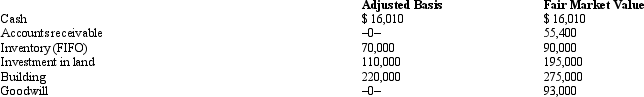

Blue Corporation elects S status effective for tax year 2012. As of January 1, 2012, Blue's assets were appraised as follows.

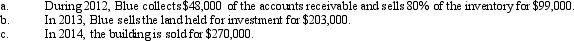

In each of the following situations, calculate any built-in gains tax, assuming that the highest corporate tax rate is 35%. C corporation taxable income would have been $100,000.

In each of the following situations, calculate any built-in gains tax, assuming that the highest corporate tax rate is 35%. C corporation taxable income would have been $100,000.

Correct Answer:

Verified

Q145: Explain how the domestic production activities deduction

Q145: Estela, Inc., a calendar year S corporation,

Q149: Trent Huynh is a 45% owner of

Q151: Individuals Adam and Bonnie form an S

Q151: Milke, Inc., an S corporation, has gross

Q152: Towne, Inc., a calendar year S corporation,

Q154: Bidden, Inc., a calendar year S corporation,

Q155: Discuss the two methods of allocating tax-related

Q157: During 2012, Rasic, the sole shareholder of

Q159: List some of the separately stated items

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents