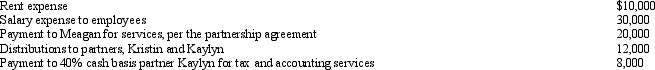

Meagan is a 40% general partner in the calendar year, cash basis MKK Partnership.The partnership received $100,000 income from services and paid the following other amounts:

How much will Meagan's adjusted gross income increase as a result of the above items?

How much will Meagan's adjusted gross income increase as a result of the above items?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Cassandra is a 10% limited partner in

Q143: Your client has operated a sole proprietorship

Q145: Hannah sells her 25% interest in the

Q149: In a proportionate liquidating distribution in which

Q150: In a proportionate liquidating distribution in which

Q153: The MOG Partnership reports ordinary income of

Q167: In the current year, Derek formed an

Q170: Jeordie and Kendis created the JK Partnership

Q183: Sarah contributed fully depreciated ($0 basis) property

Q204: Sharon and Sue are equal partners in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents