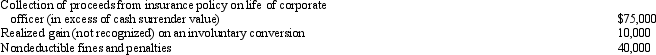

Platinum Corporation, a calendar year taxpayer, has taxable income of $500,000.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

A) $455,000.

B) $535,000.

C) $545,000.

D) $625,000.

E) None of the above.

Correct Answer:

Verified

Q21: When current E & P has a

Q43: At a time when Blackbird Corporation had

Q44: At the time of her death, Janice

Q49: Grackle Corporation (E & P of $600,000)

Q51: Puffin Corporation's 2,000 shares outstanding are owned

Q51: Tern Corporation, a cash basis taxpayer, has

Q52: Yolanda owns 60% of the outstanding stock

Q52: Reginald and Roland (Reginald's son) each own

Q56: In applying the stock attribution rules to

Q57: As a result of a redemption, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents