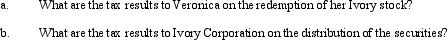

Ivory Corporation (E & P of $650,000) has 1,000 shares of common stock outstanding owned by unrelated parties as follows: Veronica, 500 shares, and Tommie, 500 shares. Veronica and Tommie each paid $125 per share for the Ivory stock 12 years ago.In May of the current year, Ivory distributes securities held as an investment (basis of $140,000, fair market value of $250,000) to Veronica in redemption of 200 of her shares.

Correct Answer:

Verified

Q132: Tanya is in the 35% tax bracket.

Q134: Puce Corporation, an accrual basis taxpayer, has

Q138: Steve has a capital loss carryover in

Q139: Brown Corporation, an accrual basis corporation, has

Q145: What are the tax consequences of a

Q152: Ashley, the sole shareholder of Hawk Corporation,

Q155: Finch Corporation (E & P of $400,000)

Q158: Thrush, Inc., is a calendar year, accrual

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Q178: How does the payment of a property

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents