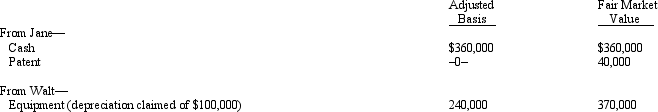

Four individuals form Chickadee Corporation under § 351.Two of these individuals, Jane and Walt, made the following contributions:  Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of the above.

Correct Answer:

Verified

Q44: Rachel owns 100% of the stock of

Q45: Tom and George form Swan Corporation with

Q58: Dick, a cash basis taxpayer, incorporates his

Q61: George transfers cash of $150,000 to Finch

Q63: Dawn, a sole proprietor, was engaged in

Q64: Joe and Kay form Gull Corporation.Joe transfers

Q72: Kirby and Helen form Red Corporation. Kirby

Q73: Sarah and Tony (mother and son) form

Q92: George (an 80% shareholder) has made loans

Q100: Eve transfers property (basis of $120,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents