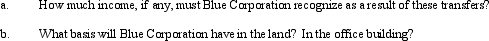

In order to encourage the redevelopment of its urban center, the city of Birmingham contributes undeveloped land (fair market value of $900,000) and cash of $350,000 to Blue Corporation. Within the year, Blue constructs a new office building at the site at a cost of $850,000.

Correct Answer:

Verified

Q82: What are the tax consequences if an

Q83: In 2005, Donna transferred assets (basis of

Q87: When Pheasant Corporation was formed under §

Q87: Barry and Irv form Rapid Corporation. Barry

Q89: Issues relating to basis arise when a

Q91: Lark City donates land worth $300,000 and

Q92: Linda formed Pink Corporation with an investment

Q93: Five years ago, Joe, a single taxpayer,

Q102: For transfers falling under § 351, what

Q104: When forming a corporation, a transferor-shareholder may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents