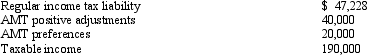

Meg, who is single and age 36, provides you with the following information from her financial records.  Calculate her AMT exemption for 2012.

Calculate her AMT exemption for 2012.

A) $0.

B) $23,450.

C) $14,075.

D) $48,450.

E) None of the above.

Correct Answer:

Verified

Q42: The AMT exemption for a C corporation

Q46: The C corporation AMT rate can be

Q49: Which of the following statements is incorrect?

A)If

Q50: All of a C corporation's AMT is

Q51: For individual taxpayers, the AMT credit is

Q52: Which of the following statements is correct?

A)If

Q54: Certain adjustments apply in calculating the corporate

Q60: Kay had percentage depletion of $119,000 for

Q61: Ted, who is single, owns a personal

Q74: Akeem, who does not itemize, incurred a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents