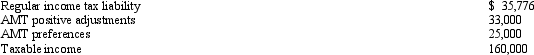

Miriam, who is a head of household and age 36, provides you with the following information from her financial records for 2012.  Calculate her AMTI for 2012.

Calculate her AMTI for 2012.

A) $0.

B) $171,300.

C) $195,925.

D) $218,000.

E) None of the above.

Correct Answer:

Verified

Q22: The AMT adjustment for research and experimental

Q26: If a gambling loss itemized deduction is

Q34: Because passive losses are not deductible in

Q34: The deduction for personal and dependency exemptions

Q35: Tammy expensed mining exploration and development costs

Q46: Prior to the effect of the tax

Q48: Jackson sells qualifying small business stock for

Q51: For regular income tax purposes, Yolanda, who

Q53: Ashly is able to reduce her regular

Q54: Interest income on private activity bonds issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents