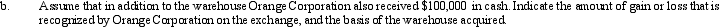

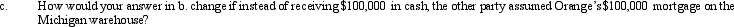

a. Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000) for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange, and the basis of the warehouse acquired.

Correct Answer:

Verified

Q28: Janet, age 68, sells her principal residence

Q32: Use the following data to determine the

Q32: Evelyn's office building is destroyed by fire

Q33: Justin owns 1,000 shares of Oriole Corporation

Q34: Samuel's hotel is condemned by the City

Q35: For each of the following involuntary conversions,

Q36: Lynn transfers her personal use automobile to

Q39: For the following exchanges, indicate which qualify

Q216: When a property transaction occurs, what four

Q252: Define a bargain purchase of property and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents