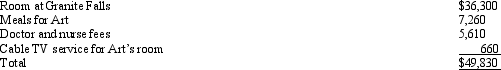

Liz, who is single, travels frequently on business. Art, Liz's 84-year-old dependent grandfather, lived with Liz until this year when he moved to Granite Falls Nursing Home because he needs daily medical and nursing care. During the year, Liz made the following payments to Granite Falls on behalf of Art:  Granite Falls has medical staff in residence. Disregarding the 7.5% floor, how much, if any, of these expenses qualifies as a medical expense deduction by Liz?

Granite Falls has medical staff in residence. Disregarding the 7.5% floor, how much, if any, of these expenses qualifies as a medical expense deduction by Liz?

A) $5,610.

B) $41,910.

C) $49,170.

D) $49,830.

E) None of the above.

Correct Answer:

Verified

Q43: Ronaldo contributed stock worth $12,000 to the

Q43: Roger is employed as an actuary.For calendar

Q44: The reduced deduction election enables a taxpayer

Q46: Any capital asset donated to a public

Q47: The phaseout of certain itemized deductions has

Q51: Jerry pays $5,000 tuition to a parochial

Q54: During the year, Eve (a resident of

Q56: Fred and Lucy are married and together

Q57: Al contributed a painting to the Metropolitan

Q58: In order to dissuade his pastor from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents