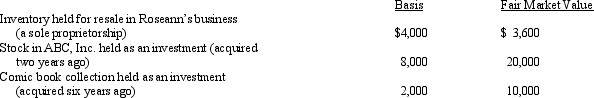

In 2012, Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

The ABC stock and the inventory were given to Roseann's church, and the comic book collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Roseann's charitable contribution deduction for 2012 is:

A) $14,000.

B) $25,600.

C) $26,000.

D) $33,600.

E) None of the above.

Correct Answer:

Verified

Q61: Emily, who lives in Indiana, volunteered to

Q62: In 2012, Boris pays a $3,800 premium

Q63: In Shelby County, the real property tax

Q66: David, a single taxpayer, took out a

Q67: Pedro's child attends a school operated by

Q71: Karen, a calendar year taxpayer, made the

Q71: In 2012, Jerry pays $8,000 to become

Q72: During 2012, Nancy paid the following taxes:

Q77: Ron and Tom are equal owners in

Q80: Phillip developed hip problems and was unable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents