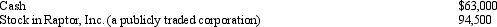

During 2012, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for 2012 is $189,000. What is Ralph's charitable contribution deduction for 2012?

A) $56,700.

B) $63,000.

C) $94,500.

D) $157,500.

E) None of the above.

Correct Answer:

Verified

Q87: During the current year, Maria and her

Q90: In 2012, Shirley sold her personal residence

Q91: George is single, has AGI of $255,300,

Q91: Which of the following items would be

Q93: Charles, who is single, had AGI of

Q94: Virginia had AGI of $100,000 in 2012.

Q94: During 2012, Kathy, who is self-employed, paid

Q96: Marilyn is employed as an architect.For calendar

Q96: In 2005, Ross, who is single, purchased

Q100: Donald owns a principal residence in Chicago,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents