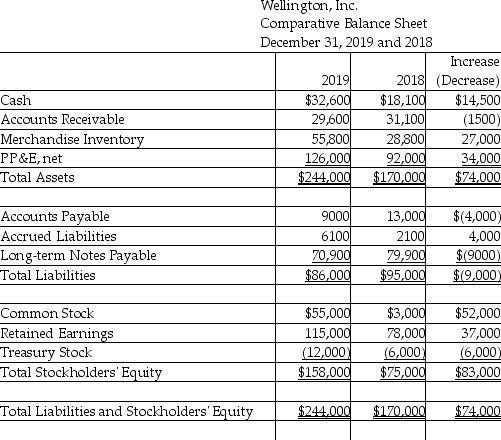

Wellington, Inc. uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ended December 31, 2019:

Use the direct method to compute the total cash receipts from operating activities.

A) $288,700

B) $293,800

C) $259,100

D) $296,800

Correct Answer:

Verified

Q141: Greene Electric Company uses the direct method

Q142: When preparing the statement of cash flows,the

Q148: Boulevard, Inc. uses the direct method to

Q149: Jump Company uses the direct method to

Q154: Tri-City Installations Company uses the direct method

Q154: Arena, Inc. uses the direct method to

Q156: Using the direct method,interest expense paid on

Q157: Nature Metals Company uses the direct method

Q158: The net cash provided by operating activities

Q160: The only part that differs in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents