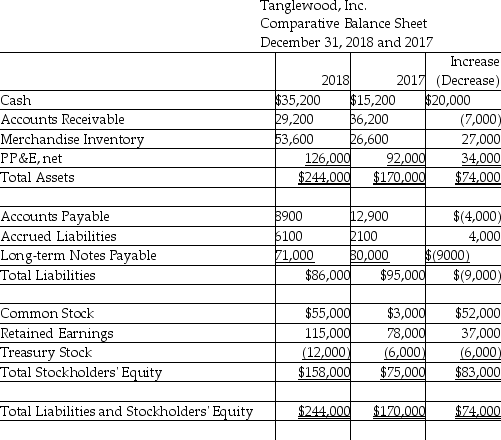

Tanglewood, Inc. uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ended December 31, 2018:  Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses. (Accrued Liabilities relate to other operating expense.)

Use the direct method to compute the payments to suppliers for Merchandise Inventory and other operating expenses. (Accrued Liabilities relate to other operating expense.)

A) $199,400

B) $179,700

C) $19,700

D) $203,400

Correct Answer:

Verified

Q124: Use the following information to calculate the

Q126: Free cash flow is calculated by adding

Q131: Wisconsin,Inc.owed one of its creditors $350,000,but it

Q135: Investors who want to know the amount

Q138: Companies sometimes obtain financing and do not

Q143: The direct method of reporting cash flows

Q145: Lightning Electric Company uses the direct method

Q146: Mid-Town Auto Parts Company uses the direct

Q150: Most public companies use the indirect method

Q151: The cash flow from investing activities section

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents