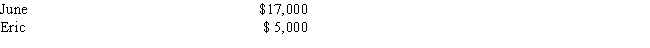

Oliver has two employees who earned the following amounts during 2016: If Oliver timely pays 5.4 percent for state unemployment tax, what is the amount of his 2016 FUTA after the state tax credit?

A) $0

B) $72

C) $112

D) $176

E) None of the above

Correct Answer:

Verified

Q47: The FUTA tax is paid by:

A)Employees only.

B)Employers

Q51: Which of the following types of income

Q58: A taxpayer would be required to pay

Q61: In 2016, Willow Corporation had three employees.

Q64: Lucinda is a self-employed veterinarian in 2016.

Q65: Sally is an employer with one employee,

Q69: The FUTA tax for 2016 is based

Q71: Choose the correct answer.Self-employment taxes:

A)Consist of Medicare

Q71: Melody and Todd are married and have

Q73: Household employers are not required to pay

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents