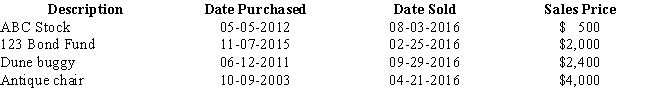

During 2016, William sold the following capital assets:

Calculate the following:

a.Total short-term capital gain/loss realized for tax purposes

b.Total long-term capital gain/loss realized for tax purposes

c.Deductible capital gain/loss

d.The amount and nature (short-term or long-term) of his capital loss carryforward

e.Assuming that William has no capital gain or loss for 2017, how much can he deduct in 2017 and what is the amount and nature of any carryforward to 2018?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: For purposes of taxation of capital gains:

A)Short-term

Q45: In October of the current year, Mike

Q49: In the current year, Henry, a sole

Q49: At the end of the current year,

Q53: In the current year, Marc, a single

Q56: In 2016, Paul, a single taxpayer, has

Q64: After 4 years of life in the

Q68: The depreciation recapture provisions are designed to

Q73: Which one of the following is true

Q78: Gain recognized on the sale of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents