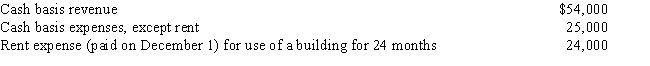

Becky is a cash basis taxpayer with the following transactions during her calendar tax year: What is the amount of Becky's taxable income from her business for this tax year?

A) $7,000 loss

B) $11,000

C) $27,500

D) $28,000

E) None of the above

Correct Answer:

Verified

Q1: Which one of the following entities cannot

Q2: The hybrid method of accounting involves the

Q7: All S corporations must use the accrual

Q7: William, a cash-basis sole proprietor, had the

Q8: Kate is an accrual basis, calendar-year taxpayer.

Q8: Under the cash basis of accounting,expenses are

Q10: Vernon is a cash basis taxpayer with

Q11: Amy is a calendar year taxpayer reporting

Q13: Which of the following is not an

Q14: The Dot Corporation has changed its year-end

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents