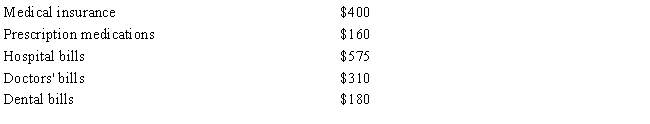

During 2016, Sarah, age 29, had adjusted gross income of $12,000 and paid the following amounts for medical expenses:

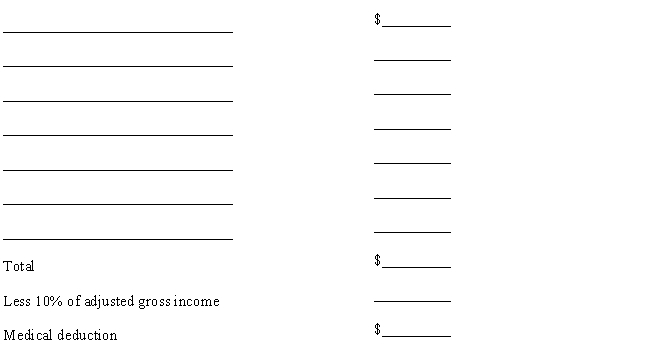

In 2016, Sarah drove 137 miles for medical transportation in her personal automobile, and she uses the standard mileage allowance. Her insurance company reimbursed Sarah $300 during the year for the above medical expenses. Using the schedule below, calculate the amount of Sarah's deduction for medical and dental expenses for the 2016 tax year.

Correct Answer:

Verified

Q1: Which of the following is not an

Q6: In 2016, David, age 65, had adjusted

Q6: Randy is advised by his physician to

Q12: The adjusted gross income (AGI)limitation on medical

Q15: Roberto, age 50, has AGI of $110,000

Q45: The cost of a chiropractor's services qualifies

Q45: Which of the following is not deductible

Q54: Premiums paid for life insurance policies are

Q58: Which of the following is not considered

Q59: If a taxpayer installs special equipment in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents