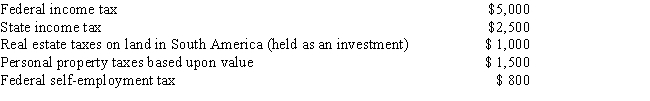

During the current year, Seth, a self-employed individual, paid the following taxes: What amount can Seth claim as an itemized deduction for taxes paid during the current year, assuming he elects to deduct state and local income taxes?

A) $2,400

B) $3,300

C) $4,200

D) $5,000

E) None of the above

Correct Answer:

Verified

Q18: Jon, age 45, had adjusted gross income

Q20: During the current year, Mary paid the

Q22: During the current year, Mr. and Mrs.

Q24: Meade paid $5,000 of state income taxes

Q25: Weber resides in a state that imposes

Q53: Jake developed serious health problems and had

Q54: Premiums paid for life insurance policies are

Q56: The cost of over-the-counter aspirin and decongestants

Q63: To calculate the amount of state and

Q63: Daniel lives in a state that charges

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents