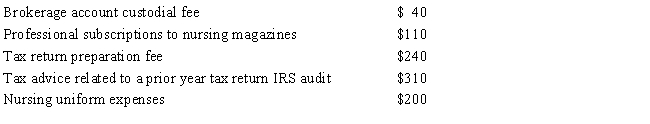

During the current tax year, Ruth, a nurse at Dr. Pan's office, incurred the following expenses:

If Ruth's adjusted gross income is $29,000, calculate her net miscellaneous deductions after the adjusted gross income percentage limitation.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Expenses of education to improve or maintain

Q109: Unreimbursed employee business expenses are miscellaneous itemized

Q111: Which of the following miscellaneous deductions are

Q113: Jean's employer has an accountable plan for

Q115: The cost of uniforms is deductible only

Q116: If an employee receives a reimbursement for

Q116: What income tax form does an employee

Q120: State if the following miscellaneous expenses are:

(1)

Q124: All taxpayers may deduct up to $4,000

Q139: April and Wilson are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents