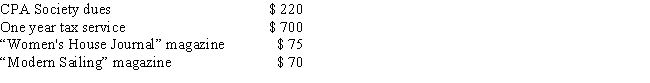

Catherine is a CPA employed by a large accounting firm in San Francisco. In the current year, she paid the following amounts: How much may she deduct on Schedule A as a miscellaneous deduction, before considering the 2 percent of adjusted gross income limitation?

A) $220

B) $920

C) $990

D) $1,065

E) None of the above

Correct Answer:

Verified

Q122: Which of the following is correct for

Q127: Rob's employer has an accountable plan for

Q130: Rachel's employer does not have an accountable

Q132: Tom is employed by a large consulting

Q133: Toni and Beyonze are married and file

Q133: Mary Lou took an $8,000 distribution from

Q135: Charlie is a single taxpayer with income

Q136: Phillip,a single parent,would like to contribute $1,800

Q138: For married taxpayers filing a joint return

Q141: Alicia is a single taxpayer with AGI

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents