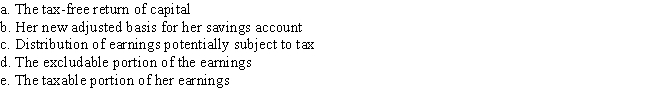

Melissa took a $1,500 distribution from her educational savings account and used $1,200 to pay for qualified education expenses. Before the distribution, Melissa's account balance was $4,000, of which $1,000 was earnings. Calculate the following:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: Which of the following employees may deduct

Q126: Charles, a corporate executive, incurred business related,

Q129: Lourdes is a paralegal.Since she often deals

Q130: Jennie receives $12,000 (of which $2,000 is

Q130: Rachel's employer does not have an accountable

Q132: Geoffrey receives $20,000 from a qualified tuition

Q132: Tom is employed by a large consulting

Q136: Which of the following is true with

Q138: Itemized deductions are subject to a phase-out

Q139: April and Wilson are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents