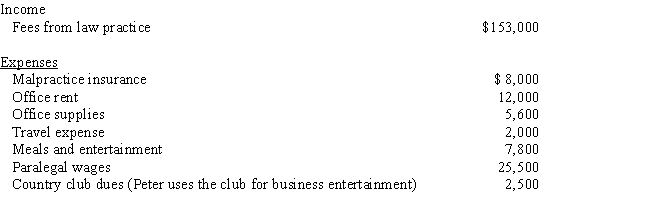

Peter is a self-employed attorney. He gives the following information about his business to his CPA for use in preparing his 2016 tax return:

Peter also drove his car 5,528 miles for business and used the standard mileage method for computing transportation costs. How much will Peter show on his Schedule C for 2016 for:

a.Income

b.Tax deductible expenses

c.Taxable income

Correct Answer:

Verified

Q3: Stone Pine Corporation, a calendar year taxpayer,

Q6: Brandi operates a small business and employs

Q15: The taxpayer must use either the FIFO

Q15: Schedule C or Schedule C-EZ may be

Q16: Patricia is a business owner who is

Q19: Once the election to use the LIFO

Q21: Curt is self-employed as a real estate

Q25: The cost of transportation from New York

Q34: For an expense to qualify as a

Q35: If a taxpayer works at two or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents