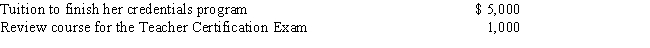

Natasha is a self-employed private language tutor. In 2016, she obtained her teaching credentials, hoping to receive a job as a seventh grade public school English teacher. She had the following education expenses for the year:

Natasha also attended a seminar in Washington, D.C., titled "The Motivated Student." Her expenses for the trip are as follows:

Determine how much of the above expenses are deductible on her Schedule C.

Determine how much of the above expenses are deductible on her Schedule C.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: If an employer chooses a per diem

Q54: If a per diem method is not

Q59: Dennis, the owner of Dennis Company, incurs

Q61: Sally is a high school math teacher.

Q62: To be deductible as the cost of

Q66: In which of the following situations may

Q70: Carol, a CPA, is always required by

Q70: The cost of a subscription to the

Q79: Which of the following does not give

Q80: The cost of a blue wool suit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents