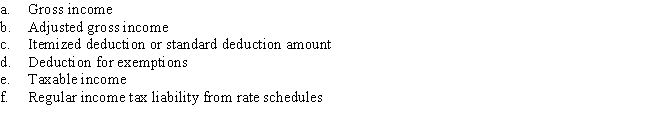

Betty, age 39 and Steve, age 50, are married with two dependent children. They file a joint return for 2016. Their income from salaries totals $155,000; they receive $1,000 in taxable interest and $2,000 in royalties. Their deductions for adjusted gross income amount to $3,100; they have itemized deductions totaling $41,000. Calculate the following amounts:

Correct Answer:

Verified

Q6: Which of the following is not considered

Q21: Oscar and Mary have no dependents and

Q22: Kenzie is a research scientist in Tallahassee,

Q23: Barry is age 45 and a single

Q25: Rod, age 50, and Ann, age 49,

Q27: Roger, age 39, and Lucy, age 37,

Q28: Steven, age 35 and single, is a

Q29: An individual is a head of household.

Q30: Eugene and Velma are married. For 2016,

Q31: Eugene and Velma are married. For 2016,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents