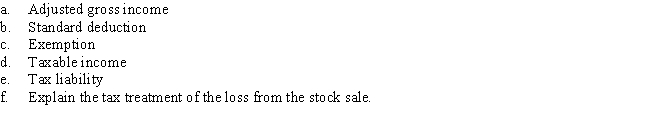

In 2016, Len has a salary of $40,700 from his job. He also has interest income of $400. Len is single and has no dependents. During the year, Len sold stock held as an investment for a $10,000 loss. Calculate the following amounts for Len:

Correct Answer:

Verified

Q1: Married taxpayers may double their standard deduction

Q11: An item is not included in gross

Q19: For taxpayers who do not itemize deductions,

Q31: Eugene and Velma are married. For 2016,

Q32: Nathan is 24 years old, single, and

Q33: Melissa is a 35-year-old single taxpayer with

Q37: Hansel and Gretel are married taxpayers who

Q37: What is the formula for computing taxable

Q38: Mary is age 33 and a single

Q46: Taxpayers with self-employment income of $400 or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents