John and Susan file a joint income tax return for 2016. They have two dependent children, students, ages 19 and 20. John earns wages of $108,000 and they have interest income of $2,000. In 2016, they settle a state tax audit and pay $50,000 for back state taxes due to an overly aggressive tax-sheltered investment.

Their other expenses for the year include:

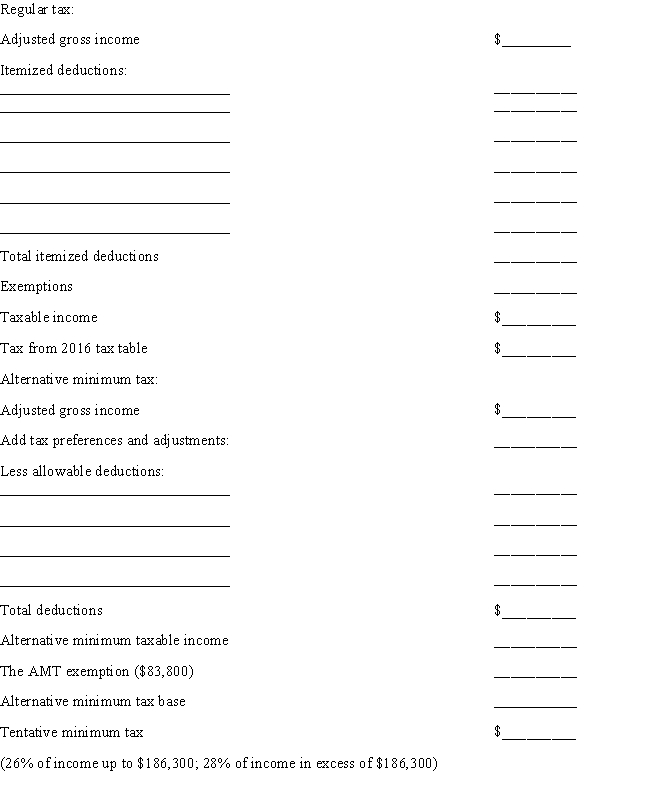

a.Calculate John and Susan's 2016 regular tax and tentative minimum tax on the schedule provided.

b.How much is the total tax liability shown on John and Susan's 2016 Form 1040?

Correct Answer:

Verified

Q50: Steve goes to Tri-State University and pays

Q57: Household income for purpose of the premium

Q58: Which of the following is not an

Q59: After raising two children, Anh, a single

Q61: Carla and Bob finalized an adoption in

Q64: In 2016, Brady purchases a 2016 Nissan

Q66: Choose the correct statement:

A)A taxayer may

Q67: For all taxpayers, except those married filing

Q71: In calculating the individual AMT,the tentative minimum

Q72: The alternative minimum tax must be paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents