Martin Corporation sells $200,000, 12%, 10-year bonds at face value on January 1. Interest is paid on January 1 and July 1. The entry to record the issuance of the bonds on January 1 is:

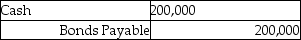

A)

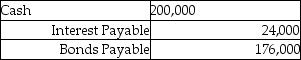

B)

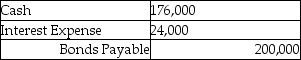

C)

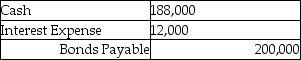

D)

Correct Answer:

Verified

Q26: At the time a bond was sold

Q30: Bonds that are backed solely by the

Q31: Allan Corporation issued 300,8%,10-year,$1,000 bonds on July

Q36: On October 1,Allan Company issued 8%,10-year,$300,000 bonds

Q38: The primary difference between secured bonds and

Q45: On January 1,20XX,Edward Company issued $200,000,10-year,8% bonds

Q48: Bond interest expense is tax deductible only

Q49: To determine the interest payment on a

Q52: Using the straight-line method,the semiannual bond interest

Q59: On April 1,20XX,Jones Company issued $200,000,10-year,6% bonds

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents