Manning Corporation sells $200,000, 12%, 10-year bonds for 96 on January 1. Interest is paid on January 1 and July 1. Straight-line amortization is used. The entry to record the issuance of the bonds on January 1 is:

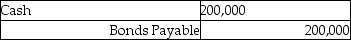

A)

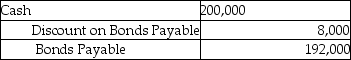

B)

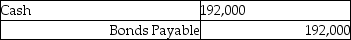

C)

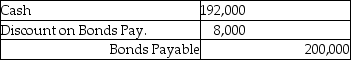

D)

Correct Answer:

Verified

Q19: A discount amortization does not affect the

Q81: A bond issue of $500,000 sold at

Q85: Northern Union Pacific is planning to issue

Q87: A bond's discount is amortized over the

Q89: The interest method for amortization of bonds

Q90: The carrying value of a bond _

Q92: On January 1,Preston Corporation issued 6%,20-year bonds

Q96: On July 1,Ball Computer Corporation issued 10-year,8%,$100,000

Q97: Bonds discount and bonds premium are liabilities

Q106: On July 1, Carly Corporation issued 10-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents