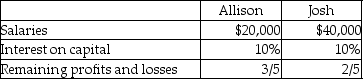

Allison and Josh are partners in a business. Allison's capital is $60,000 and Josh's capital is $100,000. Profits for the year are $80,000. They agree to share profits and losses as follows:  Allison's share of the profits before paying salaries and interest on capital is:

Allison's share of the profits before paying salaries and interest on capital is:

A) $48,000.

B) $22,000.

C) $28,000.

D) $28,400.

Correct Answer:

Verified

Q24: A partnership is defined by the Uniform

Q28: Prepare the journal entry to record the

Q30: Which method of allocation of profits and

Q30: The net income earned by the Cooper,Cross,and

Q31: Unlimited liability means that the act of

Q32: Prepare the journal entry to record the

Q33: Discuss (a) the purpose of the articles

Q34: The agreed-upon ratio for dividing earnings or

Q39: Applying the interest allowance method,compute Julie and

Q53: The journal entry to close a net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents