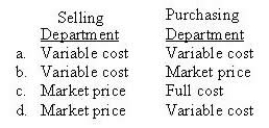

Which prices are recorded by departments under a dual-rate transfer pricing system?

A) Variable cost/Variable cost

B) Variable cost/Market price

C) Market price/Full cost

D) Market price/Variable cost

Correct Answer:

Verified

Q53: Which of the following is an advantage

Q54: Teresa's Taco Ltd had the following results

Q55: Managers are held responsible for revenues in

Q56: Responsibility accounting includes Q59: An advantage of centralised decision making is Q62: Problems with market-based transfer prices include: Q62: Teresa's Taco Ltd had the following results Q63: Teresa's Taco Ltd had the following results Q72: When a company uses activity-based transfer prices: Q90: Division S sold a part to both![]()

A)

A) Lack

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents