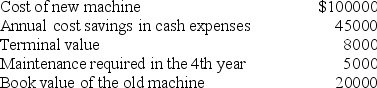

Arnold is acquiring a new machine with a life of 5 years for use on its production line. The following data relate to this purchase:  The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The present value of the cash flows from the sale of the old machine is

A) $15,000

B) $13,395

C) $16,340

D) $17,860

Correct Answer:

Verified

Q54: Arnold is acquiring a new machine with

Q55: Brisbane Hospital is considering the purchase of

Q56: Bailey Pty Ltd is considering modernising its

Q57: Apex Ltd has $100,000 available for long-term

Q58: The payback period is deficient as a

Q60: Bailey Pty Ltd is considering modernising its

Q61: The incremental cash tax flow for a

Q62: A depreciable asset's taxable basis is calculated

Q63: Sebastian is presenting a capital budgeting project

Q66: If nominal cash flow is calculated as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents