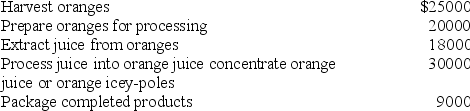

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Which of the following activities is likely to be classified as product-level?

A) Packaging

B) Harvesting

C) Extracting

D) Prepare oranges for processing

Correct Answer:

Verified

Q38: Le Pavilion is a historic hotel just

Q39: APL Ltd allocates overhead to cost objects

Q40: One of the uncertainties associated with ABC

Q41: The salary of the manager of a

Q42: Tutors-R-Us provides academic enrichment and review activities

Q42: In an ABC system, a cost driver

Q47: The FSOJ Company undertakes the following activities

Q48: Which category of the ABC hierarchy has

Q56: Which of the steps listed below normally

Q59: Which of the following is not part

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents