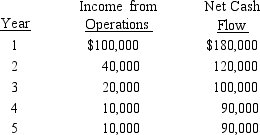

The management of Idaho Corporation is considering the purchase of a new machine costing $430,000.The company's desired rate of return is 10%.The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively.In addition to the foregoing information, use the following data in determining the acceptability of this investment:  The net present value for this investment is

The net present value for this investment is

A) $16,400

B) $25,200

C) $99,600

D) $126,800

Correct Answer:

Verified

Q121: Using the tables above,what would be the

Q122: Which of the following would not be

Q123: Which of the following is not considered

Q130: All of the following qualitative considerations may

Q132: Which of the following provisions of the

Q135: The production department is proposing the purchase

Q136: A company is contemplating investing in a

Q136: The production department is proposing the purchase

Q137: Using the tables above,what is the present

Q138: T-Bone Company is contemplating investing in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents