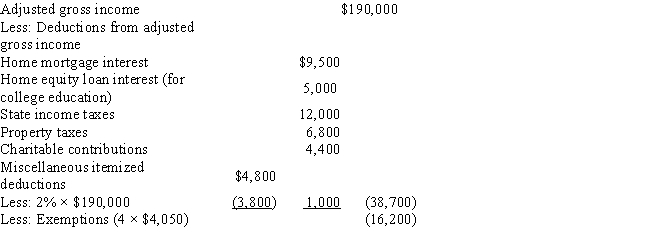

Rodrigo and Raquel are married with 2 dependent children,age 18 and 20,and reported the following items on their 2017 tax return:

Determine Rodrigo and Raquel's regular tax liability and,if applicable,the amount of their alternative minimum tax.

Correct Answer:

Verified

Q77: Which of the following credits can not

Q81: Abraham establishes a Roth IRA at age

Q82: Jane is a partner with Smithstone LLP.

Q95: Match each statement with the correct term

Q97: Roland is an employee with the Belmont

Q98: Which of the following is (are)AMT tax

Q101: On January 3,2017,Great Spirit Inc. ,grants Jordan

Q103: On May 1,2016,Peyton is granted the right

Q106: Eileen is a single individual with no

Q107: Drew is a partner with Peyton LLP.Peyton

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents