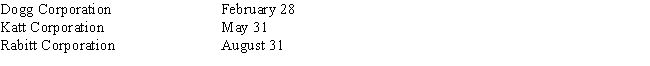

Dogg Corporation,Katt Corporation,and Rabitt Corporation are equal partners in Critter Partnership.The partner's fiscal year ends follow:

Which of the following statements is (are) correct?

I.Critter Partnership may elect to use any of the three dates that the partners use.

II.Critter Partnership must use the tax year of the partner that creates the least amount of deferral.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q46: Jack owns a 50% interest in the

Q47: Chase, Marty and Barry form a partnership.

Q57: Larry and Laureen own LL Legal Services

Q60: Rosen Group has a company health-care plan

Q60: "Double taxation" occurs

A)because corporate tax rates are

Q61: Nick and Rodrigo form the NRC Partnership

Q62: Doug,Kate,and Gabe own Refiner Group,Inc. ,an electing

Q65: On January 5,2017,Mike acquires a 50% interest

Q66: Nigel and Frank form NFS, Inc. an

Q66: During 2017,Mercedes incorporates her accounting practice.Mercedes is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents