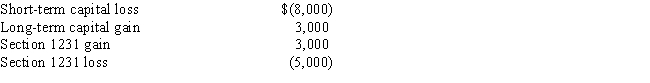

Gabrielle has the following gains and losses for the current year:

What is Gabrielle's net capital gain or loss position for the year?

A) $7,000 net short-term capital loss.

B) $3,000 net short-term capital gain.

C) $5,000 net short-term capital loss.

D) $3,000 net short-term capital gain

Correct Answer:

Verified

Q22: Long-term capital gain classification is advantageous to

Q25: Morgan has the following capital gains and

Q25: Corky receives a gift of property from

Q26: Terry receives investment property from her mother

Q26: Virginia and Dan each own investment realty

Q27: Joyce receives investment property from her mother

Q29: LeRoy has the following capital gains and

Q30: A capital asset includes which of the

Q32: Brenda sells stock she purchased in 2004

Q33: All of the following are capital assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents