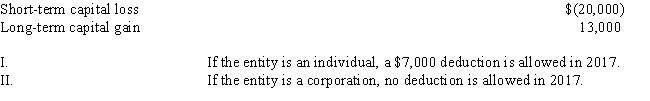

A taxable entity has the following capital gains and losses in 2017:

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q41: Sybil purchased 500 shares of Qualified Small

Q42: Raymond,a single taxpayer,has taxable income of $155,000

Q43: A taxable entity has the following capital

Q47: Santana purchased 200 shares of Neffer,Inc.Common Stock

Q47: When a security becomes worthless

I.no loss can

Q48: Sigma Corporation had the following capital gains

Q50: Victor bought 100 shares of stock of

Q51: Omicron Corporation had the following capital gains

Q52: Capital gain and loss planning strategies include

I.the

Q58: The exclusion of a percentage of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents