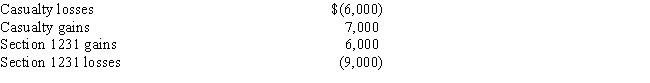

Davidson Corporation has the following gains and losses from Section 1231 property during 2017:

No net Section 1231 losses have been deducted as ordinary losses in prior years.How much of the 2017 Section 1231 gains and losses are recognized as long-term capital gains?

A) $- 0 -

B) $1,000

C) $2,000

D) $3,000

E) $6,000

Correct Answer:

Verified

Q56: The exclusion of a percentage of the

Q58: Sally owns 700 shares of Fashion Styles

Q59: Rachael purchased 500 shares of Qualified Small

Q60: Cheryl purchased 500 shares of Qualified Small

Q61: During 2017,Silverado Corporation has the following Section

Q63: Stan sells a piece of land he

Q65: Tracey sells General Electric stock (owned 10

Q68: Benjamin has a $15,000 Section 1231 gain

Q71: Hank realizes Section 1231 losses of $12,000

Q75: Assets eligible for preferential treatment under Section

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents