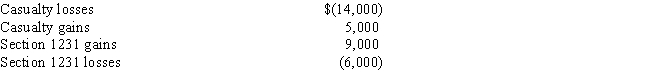

Knox Cable Corporation has the following gains and losses from Section 1231 property during 2017:

No net Section 1231 losses have been deducted as ordinary losses in prior years.How will this information affect Knox's 2017 taxable income?

A) Knox will report a net section 1231 loss of $6,000.

B) Knox will report a capital loss of $9,000 and ordinary income of $3,000.

C) The transactions have no effect on Knox's 2017 taxable income.

D) Knox will deduct a $3,000 capital loss and have ordinary income of $3,000.

E) Knox will report an ordinary loss of $9,000 and a long-term capital gain of $3,000.

Correct Answer:

Verified

Q61: Which of the following is not a

Q63: Which of the following is not a

Q64: Tory sells General Electric stock (owned 10

Q66: Which of the following properties that was

Q75: During 2017,Thomas has a net Section 1231

Q76: Tonya purchased 500 shares of Home Depot,Inc.common

Q82: During 2017,Ester recognizes a $10,000 Section 1231

Q83: Ramona recognizes a $50,000 Section 1231 loss,a

Q84: George purchased a commercial building in 1999

Q87: "Recapture of depreciation" refers to:

A)Downward adjustments of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents