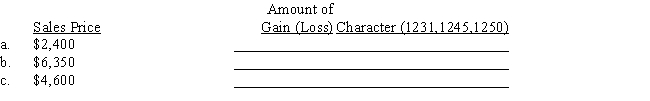

Maria acquired a personal computer to use 100% in her business for $6,000.She took MACRS deductions of $2,880 before selling it in current year.Determine the amount and character of the gain (loss)recognized on the sale of the computer,assuming a sales price that differs in each of the three independent situations:

Correct Answer:

Verified

Q118: Match each statement with the correct term

Q122: Classify the gain or loss on each

Q123: Dragonian Corporation sells a depreciable asset. Dragonian

Q123: Classify the gain or loss on each

Q126: Milton has the following transactions related to

Q130: Classify the gain or loss on each

Q132: Discuss the general differences between Section 1245

Q133: Matt has a substantial portfolio of securities.

Q134: Classify the gain or loss on each

Q139: Explain why a taxpayer would ever consider

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents