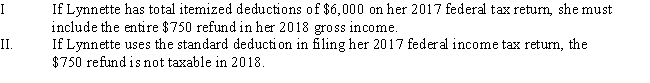

Lynnette is a single individual who receives a salary of $36,000.During 2017,she has $6,800 withheld for payment of her federal income taxes and $2,900 for her 2017 state income taxes.In 2018,she receives a $450 refund after filing her 2017 federal tax return and a $750 refund after filing her 2017 state tax return.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q44: Irene is 47 years old, unmarried, and

Q49: Marci is single and her adjusted gross

Q51: Michael,age 42 and single,has a 13-year-old son,Tony.Tony

Q52: During the current year,Robbie and Anne pay

Q55: Carlos incurs the following medical expenses during

Q56: Richard pays his license plate fee for

Q57: Tisha's husband died in 2014.She has not

Q58: Ricardo pays the following taxes during the

Q59: Which of the following qualify for the

Q59: Anita receives a state income tax refund

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents