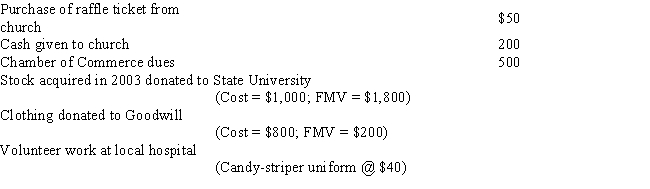

Louise makes the following contributions during the current year:

If Louise's gross income is $35,000,what is her allowable charitable contribution?

A) $1,440

B) $2,240

C) $2,290

D) $2,790

E) $2,840

Correct Answer:

Verified

Q61: Brock incurs $950 interest on his GMAC

Q62: Baylen, whose adjusted gross income is $60,000,

Q63: Carlyle purchases a new personal residence for

Q68: Certain interest expense can be carried forward

Q70: Linc,age 25,is single and makes an annual

Q71: Kristin has AGI of $120,000 in 2016

Q71: Gerald purchases a new home on June

Q75: Randolph borrows $100,000 from his uncle's bank

Q78: Bender borrows $200,000 from his uncle's bank

Q80: Hank, whose adjusted gross income is $100,000,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents