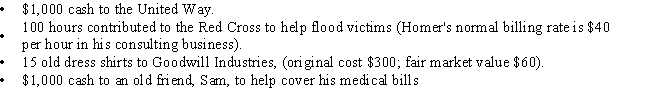

Homer has AGI of $41,500,and makes the following donations in the current year:

What is Homer's charitable contribution deduction for the current year?

A) $1,000-

B) $1,060

C) $1,300

D) $2,060

E) $6,300

Correct Answer:

Verified

Q57: Tisha's husband died in 2014.She has not

Q58: Ricardo pays the following taxes during the

Q59: Anita receives a state income tax refund

Q60: Morris is a single individual who has

Q61: Which of the following taxes is deductible

Q63: Wayne purchases a new home during the

Q64: Which of the following properties from an

Q65: Ronald pays the following taxes during the

Q66: Linda's personal records for the current year

Q67: Armando has AGI of $80,000 and makes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents