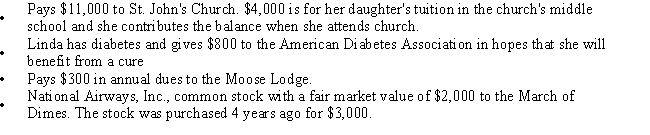

Linda's personal records for the current year show the following facts:

Linda's AGI for the current year is $32,000.What is her charitable contribution deduction?

A) $7,000

B) $9,000

C) $9,800

D) $10,800

E) $13,800

Correct Answer:

Verified

Q61: Which of the following taxes is deductible

Q62: Homer has AGI of $41,500,and makes the

Q62: Baylen, whose adjusted gross income is $60,000,

Q63: Wayne purchases a new home during the

Q64: Which of the following properties from an

Q65: Ronald pays the following taxes during the

Q67: Armando has AGI of $80,000 and makes

Q68: Certain interest expense can be carried forward

Q70: Linc,age 25,is single and makes an annual

Q71: Kristin has AGI of $120,000 in 2016

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents