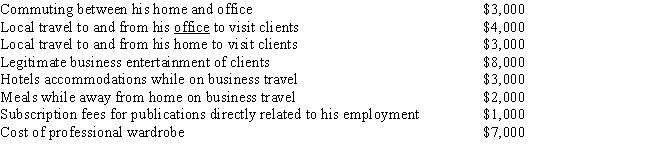

Julius is an employee of a large consulting firm.During the year he incurs the following expenses in his job,none of which are reimbursed by his employer.Julius's adjusted gross income is $100,000 before considering these expenses.

What is Julius's miscellaneous itemized deduction?

A) $14,000

B) $16,000

C) $21,000

D) $22,000

E) None of the above

Correct Answer:

Verified

Q88: Patricia contributes artwork to the art museum

Q95: Orrill is single and has custody of

Q96: Toby,a single taxpayer with no dependents,is an

Q97: Barney's sailboat is destroyed in an unusual

Q98: Robbie is 18,and a dependent on his

Q100: During 2017,Marla earns $2,700 from a summer

Q101: In which of the following circumstances will

Q102: Which of the following individuals or couples

Q103: In which of the following circumstances will

Q106: Larry is a single parent with an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents