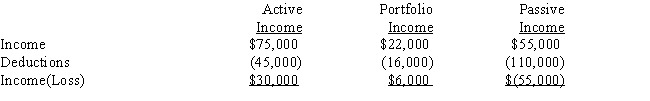

A taxpayer had the following for the current year:

I.If the taxpayer is a closely held corporation,taxable income from the three activities is income of $6,000.

II.If the taxpayer is an individual and the passive income is not related to a rental real estate activity,taxable income is $36,000.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q26: During the current year, Alyssa incurred a

Q27: During 2017,Pamela worked two "jobs." She performed

Q28: Salvador owns a passive activity that has

Q29: During the year, Aimee reports $30,000 of

Q30: Pedro owns a 50% interest in a

Q31: Susan is the owner of a 35-unit

Q32: Janine is an engineering professor at Southern

Q33: If an individual is not a material

Q37: Maria, an engineer, has adjusted gross income

Q40: Sullivan, a pilot for Northern Airlines, has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents