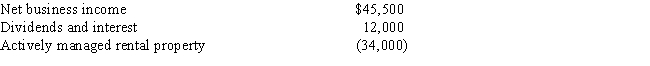

Karl has the following income (loss) during the current year:

What is Karl's adjusted gross income for this year?

A) $23,500

B) $31,400

C) $32,500

D) $45,500

E) $57,500

Correct Answer:

Verified

Q27: Which of the following must be classified

Q36: Travis is a 30% owner of 3

Q39: If a taxpayer has the following for

Q39: Nancy is the owner of an apartment

Q42: During the current year, Diane disposes of

Q43: Tim owns 3 passive investments.During the current

Q44: Linda owns three passive activities that had

Q46: Judy and Larry are married and their

Q47: Nelson is the owner of an apartment

Q50: Rose has an adjusted gross income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents