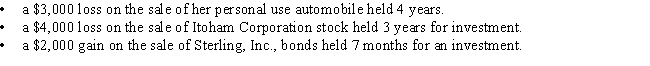

During the current year,Cathy realizes

Determine the tax consequences of these events.

A) Cathy deducts a $5,000 net capital loss.

B) Cathy deducts a $3,000 net capital loss.

C) Cathy deducts a $2,000 net capital loss.

D) Cathy deducts a $1,000 net capital loss.

E) Cathy deducts a $7,000 net capital loss.

Correct Answer:

Verified

Q83: Match each statement with the correct term

Q90: Match each statement with the correct term

Q91: The wash sale provisions apply to which

Q92: Samantha sells the following assets and realizes

Q93: Willie sells the following assets and realizes

Q94: During the year, Daniel sells both of

Q94: Jerome owns a farm,which has three separate

Q98: The wash sale provisions apply to which

Q99: During the year,Shipra's apartment is burglarized and

Q105: Match each statement with the correct term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents