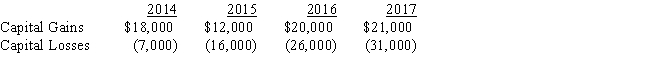

The Corinth Corporation is incorporated in 2014 and had no capital asset transactions during the year.From 2014 through 2017,the company had the following capital gains and losses:

If Corinth's marginal tax rate during each of these years is 34%,what is the effect of Corinth's capital gains and losses on the amount of tax due each year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Match each statement with the correct term

Q119: If a corporation incurs a net operating

Q121: For each of the following situations, determine

Q122: Gloria owns 750 shares of the Greene

Q123: Hubert and Jared are both involved in

Q124: Brent is single and owns a passive

Q125: Fowler sells stock he had purchased for

Q126: For each of the following situations, determine

Q128: Why do the wash sale rules apply

Q129: During the year Wilbur has the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents